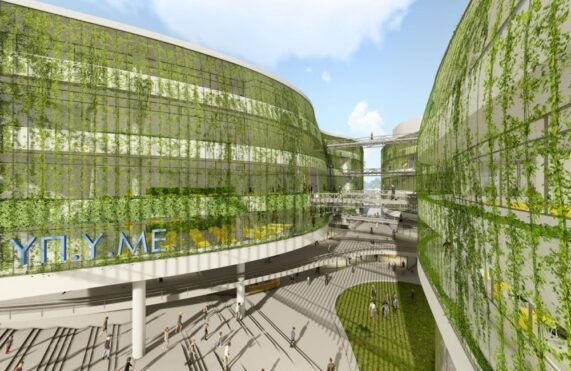

It is a fact that PPPs implemented in the country have been successful with the model evolving into a powerfiul tool for the realization of serious infrastructure projects. Schools, Fire Stations, Transport Systems, Waste Treatment Units etc. are included in a list of projects that compose a new logic on how the State cooperates with the private sector, in a country where the relations of both parties are not particularly amicable.

PPPs are not considered a “crutch” option anymore for projects that would otherwise never be realized, an achievement that can be largely attributed to the Special PPP Secretariat. PPP projects are now an increasingly attractive option by prospective implementing entities in order for them to insure better quality projects, better financing, more adequate maintenance during the period of operation and a guarantee that the project will maintain high standards throughout its life cycle.

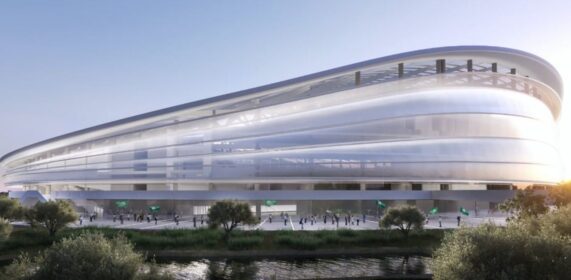

What we have not seen before, is the triumphant -as it turned out- entry of the PPPs into the field of motorway projects. The experience, so far, of the auctioning of the 22 km-long section of Crete’s Northern Motorway Axis (aka VOAK), that is intended to be implemented as a PPP, has been accepted with restrained optimism regarding the ability of the process to finally reach the signing of the contract.

However, we have to admit that VOAK’s PPP tender has found an impressive acceptance by the market, sending an encouraging message for this “heavy” infrastructure project with a considerable budget. The approximately 250m euros for its construction place this PPP project in the first place (in their short history so far) in the country in terms of budget and success, at least in this first stage.

The participation of 5 very large companies, along with the “big 3” (i.e. AKTOR, TERNA, J&P AVAX – Marguerite), MYTILINEOS – ACCIONA – INTERTOLL and Israeli power Shikun & Binui, has almost secured the overall success of the tender.

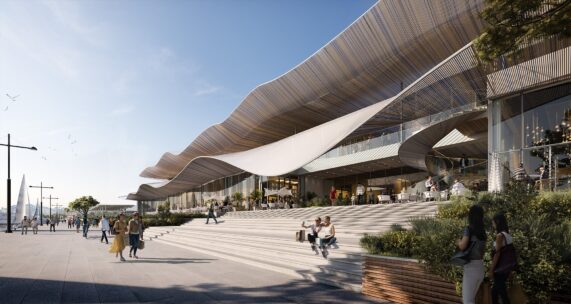

The fact that one of the largest European investment funds participated, for the first time, in an infrastructure project competition and, at the same time, big companies from Spain and Israel expressed a strong interest along with the domestic powerful players, is surely a great success. If we tried to decode the development of this competition, it could be said that PPPs have a preference for big projects, as long as their tenders are attractive to the market.

If everything well for this road PPP, it is almost certain that it will become a pilot for other similar ones, not necessarily road-related (not rail or metro), bringing to life an entirely new generation of projects, for the first time in nearly 40 years, without the need of almost exclusive funding either from the NSRF and or the Public Investment Programs, bringing in new investors from the private sector.

It is of great importance, at this time, is for the success of this “pilot tender” to be preserved after its completion and mature into a realization (by all interested parties and the State) that PPPs could work in other fields of large-scale infrastructure projects.

Of course, we must not forget that a key factor in the success of PPPs is the creation of a stable investment environement and the willingness to attract investors. This is an element that always helps or “torpedoes” a project under auctioning. The potential of this new model will be evaluated, over the next period, and we are very optimistic as Mr. Mantzoufas always finds the way to surprise us positively.

Nikos Karagiannis-ypodomes.com

ΜΗΝ ΞΕΧΑΣΕΤΕ

- Ακολουθήστε το ypodomes.com στο Google News και μάθετε πρώτοι όλες τις ειδήσεις για τις υποδομές στην Ελλάδα

- Αν είστε επαγγελματίας του κλάδου, ακολουθήστε μας στο LinkedIn

- Εγγραφείτε στο Ypodomes Web TV